Car insurance company abilene tx: key things you should know

Wiki Article

Top Factors You Need To Have Insurance for Comprehensive Security

In today's unforeseeable world, having insurance is greater than an option; it is a requirement. It supplies a safeguard versus unanticipated medical expenses, property damage, and potential obligation insurance claims. This security prolongs past private demands, impacting organizations and their capacity to flourish. Recognizing the diverse advantages of insurance can greatly modify one's approach to take the chance of and protection. The concern continues to be: exactly how can one really make the most of the benefits of considerable protection?Financial Safety And Security Against Unforeseen Medical Expenditures

While unanticipated medical costs can develop significant monetary strain, detailed insurance uses an essential safety internet (car insurance company abilene tx). People usually undervalue the potential expenses linked with clinical emergencies, from hospital remains to specialized therapies. Without sufficient coverage, also a solitary incident can result in overwhelming debt, affecting general financial securityDetailed wellness insurance offers to mitigate these risks, guaranteeing that individuals can access necessary treatment without the concern of outrageous out-of-pocket expenditures. By pooling sources, insurance allows participants to share the economic tons of unanticipated wellness concerns, advertising assurance.

Having insurance motivates timely medical interest, which can protect against small issues from escalating right into serious health crises. This aggressive technique not just safeguards personal finances however additionally enhances total health. Ultimately, robust medical insurance is an essential part of financial protection, giving people with the assurance that they can deal with unforeseen clinical challenges without devastating repercussions.

Security for Your Properties and Residential or commercial property

Possessions and home represent significant financial investments that require security versus numerous risks, consisting of theft, all-natural disasters, and crashes. Without appropriate insurance protection, people and organizations may deal with substantial monetary losses that could endanger their security. Property insurance offers a safety and security web, making sure that in the event of damage or loss, the prices of repairs or substitutes are covered. This protection can extend to homes, lorries, and beneficial individual belongings, guarding investments versus unpredicted occasions.

Responsibility Insurance Coverage to Guard Your Future

Obligation insurance coverage plays a crucial role in supplying lawful security against prospective claims and cases. It assures that people and companies can browse unforeseen conditions without risking their monetary security. By investing in comprehensive responsibility insurance, one safeguards not only their assets yet likewise their future safety.Legal Protection Perks

A thorough insurance plan frequently includes necessary lawful defense benefits that offer to guard people versus potential responsibilities. These benefits can cover legal expenditures emerging from lawsuits, making sure people are not economically bewildered by unexpected legal battles. In a lot of cases, legal depiction is vital when one deals with claims of oversight or misbehavior. Insurance coverage may likewise provide accessibility to lawful recommendations, aiding individuals navigate complicated lawful matters a lot more efficiently. Furthermore, legal protection benefits can encompass negotiations or judgments, offering satisfaction in case of negative results. By incorporating these lawful protections, individuals can protect their future against the uncertainties of lawful disputes, permitting them to concentrate on their personal and expert lives without consistent concern.Financial Protection Assurance

Extensive insurance policies often consist of vital monetary safety and security guarantee, specifically via robust liability protection that secures people from unforeseen financial worries. This kind of protection safeguards against lawful claims developing from accidents or negligence, making sure that insurance holders are not left prone to potentially disastrous costs. By providing a financial safety net, liability protection aids keep stability in individual and specialist lives, enabling people to navigate difficulties without debilitating monetary stress. In addition, it advertises peace of mind, knowing that unpredicted circumstances will certainly not hinder future strategies or financial investments. Inevitably, having comprehensive obligation coverage is a sensible selection, making it possible for people to concentrate on their pursuits and responsibilities while being assured of defense versus considerable financial threats.

Comfort in Times of Crisis

Just how can one discover solace in the middle of the turmoil of unforeseen obstacles? In times of situation, the weight of unpredictability can be frustrating. Insurance coverage supplies a crucial layer home insurance company abilene tx of protection, enabling people and families to navigate rough waters with higher self-confidence. Knowing that financial support is available throughout emergencies minimizes anxiousness, making it possible for a more clear concentrate on healing and restoring.When unexpected events happen, such as accidents or all-natural catastrophes, the psychological toll can be considerable. Insurance policy alleviates this worry by providing reassurance that losses will certainly be addressed, whether via residential property insurance coverage or health and wellness benefits. This satisfaction empowers individuals to make informed choices, fostering resilience in the face of hardship. Eventually, having insurance implies welcoming a complacency, enabling one to deal with life's changability with a steadier heart and a more clear mind, prepared to confront challenges head-on.

Assistance for Company Continuity and Development

While navigating the intricacies of the organization landscape, companies depend on insurance not only for protection but additionally for promoting connection and development. Insurance policy acts as a safety web that permits services to recuperate promptly from unanticipated occasions, such as natural calamities or accidents. This sponsorship mitigates the risks that might or else stop procedures or cause considerable losses.Furthermore, having considerable insurance facilitates strategic planning and investment. With a solid insurance framework, services can discover brand-new ventures and broaden their operations with confidence, recognizing they have a guard in position. This protection motivates innovation and the search of long-lasting goals, as organizations really feel empowered to make computed threats.

Essentially, insurance is an essential element of a durable organization technique, allowing firms to navigate challenges while keeping emphasis on development and sustainability. By focusing on substantial coverage, companies place themselves for withstanding success in an ever-evolving market.

Access to Resources and Experience in Emergency Situations

Accessibility to sources and know-how during emergency scenarios is vital for services facing unanticipated challenges. Insurance policy offers a safeguard that links companies to a network of specialists outfitted to take care of dilemmas properly. This network includes risk monitoring professionals, lawful advisors, and specialized recovery teams.In moments of distress, companies benefit from instant accessibility to specialist advice, enabling them to navigate complicated situations with self-confidence. Insurance providers often supply resources such as dilemma monitoring strategies and training sessions, boosting a business's preparedness.

Additionally, insurance can help with timely recovery by offering funds to mitigate losses and accelerate restoration efforts. This ensures that companies can promptly go back to typical operations, reducing downtime and protecting consumer trust.

Often Asked Concerns

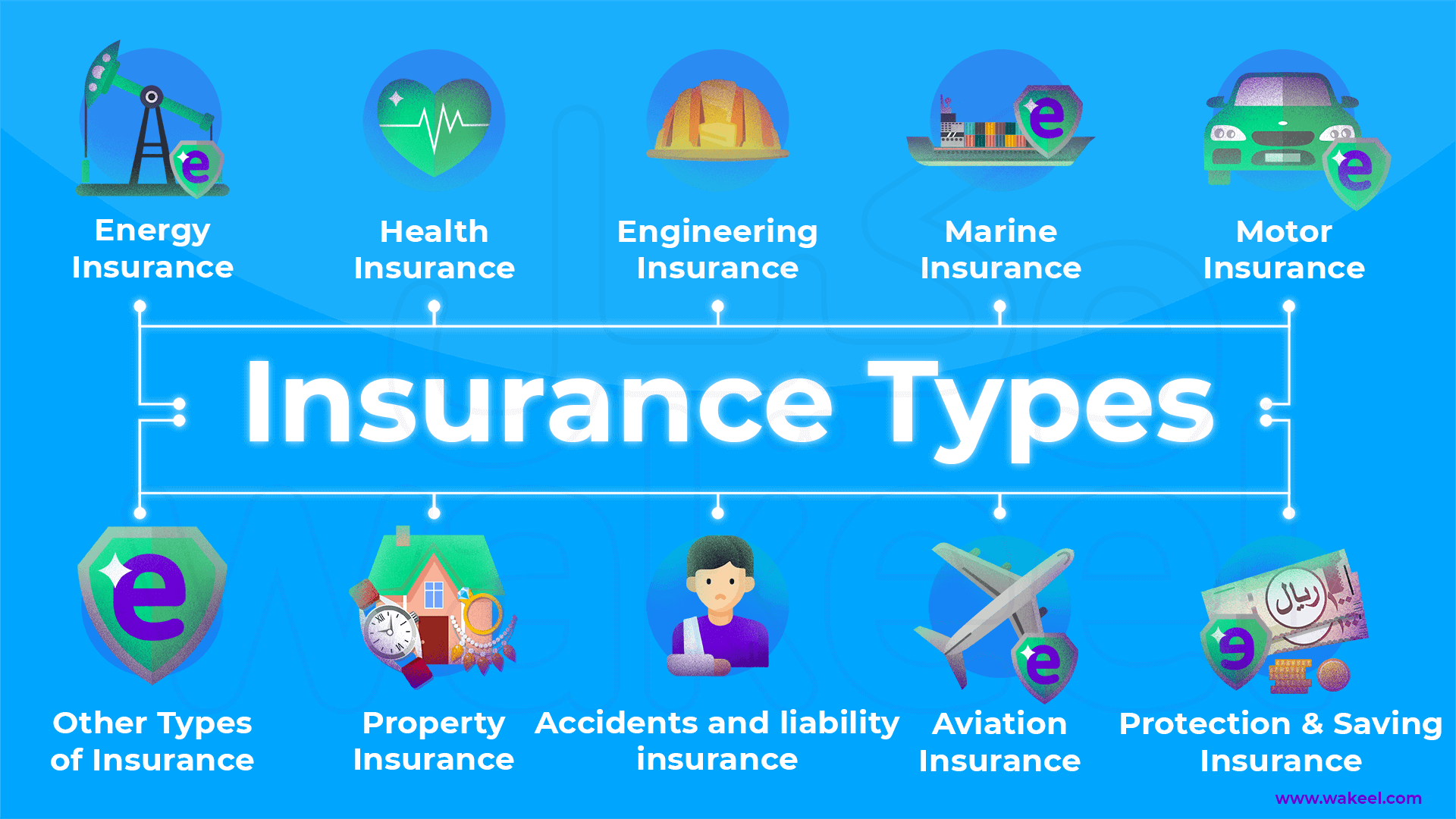

What Sorts of Insurance Are Crucial for Comprehensive Defense?

The important types of insurance for comprehensive security typically include wellness, vehicle, home owners, and life insurance policy. Each offers to mitigate financial risks related to unpredicted events, ensuring people are appropriately protected against various prospective obligations.Exactly How Does Insurance Impact My General Financial Planning?

Insurance significantly affects general monetary planning by reducing threats and prospective losses. It allows people to allocate sources much more properly, guaranteeing financial security and assurance while planning for unpredicted occasions that can interfere with financial objectives.:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Can I Tailor My Insurance Plan for Specific Demands?

The specific asked about tailoring insurance policies to fulfill particular needs. Insurance policy providers usually offer flexible options, permitting clients to customize coverage, limitations, and deductibles, ensuring alignment with personal scenarios and economic goals.What Are Usual Mistaken Beliefs About Insurance Protection?

Several individuals wrongly think that all insurance plan are the very same, that they do not require coverage till an incident happens, or that comprehensive protection is expensive. These misconceptions can bring about insufficient economic safety.Exactly how Typically Should I Testimonial My Insurance Coverage?

Assessing insurance plans annually is recommended to ensure insurance coverage continues to be adequate. Changes in individual circumstances, market conditions, or plan terms might require modifications - business insurance agent abilene tx. Regular examinations assist individuals preserve suitable defense and stay clear of potential spaces in coverageReport this wiki page